The implementation of the Goods and Services Tax in 2017 has had a large-scale impact on several goods and commodities; change in prices is one of the most noticeable. The government has levied a 3% GST rate on gold jewellery. However, the goods and services tax depends on the type of gold, imports and the sector: unorganised or organised. Knowing about the impact of GST on various kinds of gold helps you make an informed decision while buying it.

Impacts of GST on Gold

Impact on Gold

Before implementing GST, you had to pay 1% as service tax along with 1% VAT. So, in total, you had to pay 2% extra, over and above the selling price of the gold jewellery purchased. However, with the introduction of the GST gold tax rate of 3%, gold has become more expensive.

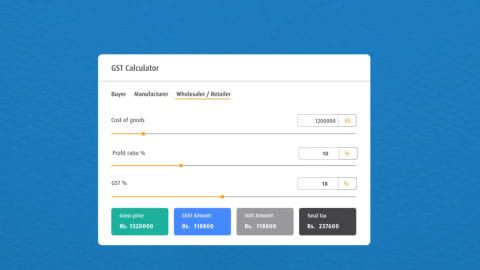

Additional Read: How to calculate GST

Impact on gold imports

With the implementation of this regime, GST on gold is 3%, in addition to an import duty of 10%. As a result, gold import rates have increased, and so, if you are planning to purchase imported gold, now isn’t the best time to do so. Planning to trade in gold is also not advisable, as rising prices have reduced the demand for gold and impacted the liquidity of such an investment.

Effect of GST on the sector

Unorganised sector

Of the 700–800 tonnes of gold that the country imports, 30 tonnes are imported illegally, smuggled primarily through the Middle East, which comprises the unorganised sector. After the hike in gold import rates, likely, it may inevitably lead to more smuggling of gold as compared to before. This is why several merchant associations have been appealing to the government to reduce the import duty on gold. However, since the GST regime requires sellers to record every transaction, it will improve authenticity and accountability to a certain degree.

Organised sector

Currently, only 30% of the gold sector is organised. The ideal impact of GST on the organised sector is to increase transparency and accountability, but it may also have the opposite effect. The high rate may lead to vendors smuggling gold or selling items without a bill.

Additional Read: GST advantages and disadvantages

Effect of GST on making charges for gold jewellery

Earlier in the industry, the making charges were fixed at 12%, with an additional 12% charged as customs. However, with the introduction of the GST, the cost of making was initially set at 18%. However, after this decision received criticism, the rate was reduced to 5%.

As a result, you can see that on the whole, the gold industry isn’t as adversely affected by GST, except the import of gold and the unorganised sector that hitherto dealt with gold, often illegally.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply