Key features and benefits of Pocket Subscription plans

-

Small-ticket assistance plans for your daily needs

Safeguard important everyday items and get financial assistance for your daily needs with our bite-sized subscription plans.

-

Affordable premiums starting at Rs. 199

You can buy Pocket Subscription plans at premiums starting at as low as Rs. 199/year.

-

Choose from a range of coverage

Get assistance cover for your specific needs, be it for health, travel, essentials, and gadgets.

-

Fraud protection coverage of up to Rs. 2 lakh

Get financial coverage of up to Rs. 2 lakh against debit and credit card frauds. This includes phishing, tele-phishing, and pin-related scams.

-

Teleconsultation and lab test coverage

With Pocket Subscription health plans, you can benefit from 24x7 teleconsultation facility and get reimbursement for lab tests taken at network labs.

-

Single-call debit/credit card blocking facility

With Wallet Care plans, you can block all your lost credit, debit, or ATM cards by calling on a 24-hour helpline number 1800-419-4000.

-

100% digital buying process

Complete a few simple steps and get your subscription plan online.

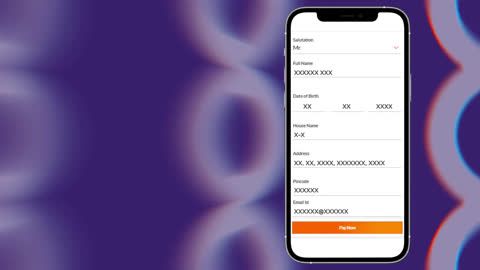

Step-by-step guide to buy Pocket Subscription plans on Bajaj Finance Insurance Mall

-

Step 1

Choose the Pocket Subscription plan that you wish to buy from the list of products shown at the top of the page. Click on the ‘Buy Now’

-

Step 2

Enter your full name as on your PAN card and mobile number. Press the ‘Submit’ button.

-

Step 3

Enter the One Time Password (OTP) received on your registered mobile number for verification.

-

Step 4

If your mobile number is present in our records, pre-filled details will appear on the form. All you need to do is to check if the details are correct.

-

Step 5

At this point, the payment page will open. Complete the online payment via UPI, net banking, credit/debit cards, and wallet.

-

Step 6

After the payment is successful, you can download the policy receipt instantly.

Download the policy document from ‘My Account’ after 5-7 working days from the purchase date.

Frequently asked questions

Road Trip Protection plan provides covers unforeseen emergencies during a road trip. The plan comes at an annual subscription of just Rs. 599.

Given below are the benefits of the plan:

1. 24x7 roadside assistance.

2. Emergency travel and hotel assistance.

3. Card block facility with a single phone call.

4. Complementary protection against personal accidents, accidental hospitalisation, and medical evacuation.

With a Personal Accident Cover, you get coverage for accidental death, permanent total and partial disablement. Membership fee for the plan starts at Rs. 230. Get a sum insured up to Rs. 25 lakh.

Yes, you can buy Bajaj Finserv Mobile Protect online. You can simply fill in the application form and make online payments through any preferred mode.

There is no such option to get a refund of your policy. Upon paying the premium, you get enrolled under the annual subscription plan.

Yes, CPP Mobile Protect Plan covers Apple phones. The premium for iPhone protection starts at a minimal subscription fee of Rs. 1,153 and is available up to Rs. 6,153. Plan’s premium varies as per the price of your mobile device.