Key features and benefits of Investment Plans

-

Get lump sum payout benefit

Investment plans offer an assured lump sum benefit on policy maturity or in case of the policyholder's death. This helps the insured or their family stay financially secure during emergencies.

-

Enjoy life cover along with additional riders

Investment plans offer sufficient life cover along with the option of availing of additional coverage to enhance your policy benefits. For example, critical illness coverage, accidental death coverage, and more.

-

Get flexible premium payment options

With flexible premium payment options, you can invest in long-term goals with convenience. You can ensure that your family is financially secure for any uncertainties.

-

Accumulate a substantial retirement corpus

Investing in investment plans helps you compound your earnings and ensures you are financially secure in your retirement age.

-

Build education fund for your children

Create a significant fund to secure your child's future with the help of child plans offered by our partners.

-

Avail tax benefits

Get tax exemptions on premiums paid for investment plans under the applicable income tax laws.

Step-by-step guide to buy Investment plans on Bajaj Finance Insurance Mall

-

Step 1

Click here to visit our online application form.

-

Step 2

Enter the required details – amount that you want to invest, name, date of birth, and contact number.

-

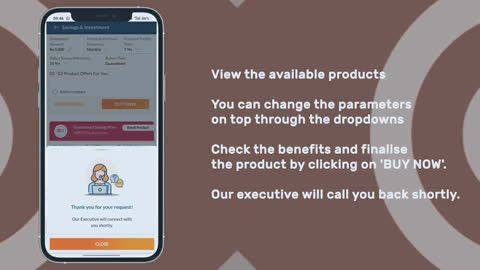

Step 3

Choose your preferred plan from the list of products shown by clicking Buy Now.

-

Step 4

Our representative will call you back and explain the products available for you to take an informed decision.

Frequently asked questions

Savings plans help individuals earn guaranteed returns in return for disciplined savings. They help build a corpus over time and offer financial security for your loved ones' future. You can choose between a lump sum or monthly income payout options.

Check out the savings and investment plans offered by Bajaj Finance as per your goals and needs.

Investment plans enable you to invest money in a disciplined manner and create wealth for your future needs. There are various investment plans that also include the life cover element to secure your family’s future, such as ULIP (Unit Linked Insurance Plans).

One of the major differences between savings and investments is the risk factor. In savings, returns are lower but without any risks, whereas, in investments, the returns are higher, but there is an element of risk.

Savings and investment plans play a vital role in securing your future. They provide multiple options for strategic financial planning. Savings provide a safety net for unexpected expenses, and investment is a strategy for building wealth.

Yes. Savings and Investment plans offer loan facilities once the plans acquire a surrender value. The policyholder can take a loan of a maximum amount of 80% of the policy's surrender value. This depends on the policy terms and conditions.