An inflow of regular monthly income is curtailed post retirement, which makes it difficult to fund expenses. To earn and spend as you did in your pre-retirement years, use your retirement corpus wisely. You can start by exploring avenues to help you pay well, so you can multiply your corpus and earn a tidy sum at regular intervals.

Here's how to make your retirement funds pay a monthly salary.

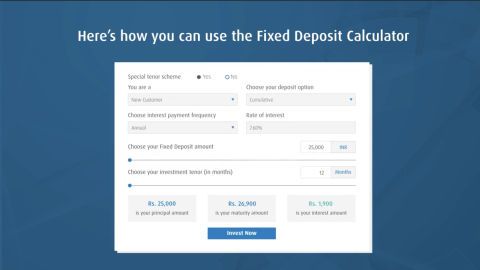

1. Deposit your EPF into a non-cumulative FD

Money from your Employee Provident Fund is accumulated wealth, which you collect throughout your working years. When you retire, you can plan wisely to make the most of this money.

Depositing this amount into a savings account will give you an average interest of 4%. However, if you're looking for greater returns without compromising on safety and stability, you can deposit your money into a non-cumulative FD that would fetch greater monthly returns.

You can also earn much higher interest by investing in Bajaj Finance Fixed Deposit.

2. Invest in the post office monthly income scheme

Under the Post Office Monthly Income Scheme or POMIS, you receive a sum monthly, starting from the date of deposit. If you re-invest a portion of your retirement savings or PPF under this scheme, then you will get an interest rate of 7.3% per annum, payable monthly.

The maximum limit for investment is Rs. 4.5 lakh for single accounts and Rs. 9 lakh for joint accounts. The maturity period of the Post Office Monthly Income Scheme is five years. So, if you invest Rs. 4.5 lakh under this monthly income scheme for 5 years, you are sure to get a monthly income of Rs. 2,737.

3. Join the Pradhan Mantri Vaya Vandana Yojana

Invest in the government's 8% pension scheme for senior citizens. Called Pradhan Mantri Vaya Vandana Yojana (PMVVY), this scheme can be purchased online. You can invest under this scheme to avail income at regular intervals for the next 10 years. If you want a monthly payout, you must invest between Rs. 1.5 lakh and Rs. 7.5 lakh. If you invest Rs. 1.5 lakh, you will get an income of Rs. 1,000 per month, and if you invest Rs. 7.5 lakh, you can get Rs. 5,000 per month.

4. Benefit from the senior citizen savings scheme

This is another avenue that can fetch you good returns once you cross the age of 55. The maturity period of a Senior Citizen Savings Scheme is 5 years, and it offers 8.3% interest. Should you wish to, you can extend your SCSS by 3 more years.

Apart from this, investment under this scheme will allow you to avail tax benefits under Section 80C of the Income Tax Act. Investment in SCSS is tax-deductible provided the amount is less than Rs. 1.5 lakh. So, if you deposit Rs. 3 lakh in this account, you will earn Rs. 6,225 as interest every quarter.

Rather than keeping your returns post-retirement in a savings account, re-invest your money in these investments of India to get monthly income.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply