Experiencing an influx of emotions as you near retirement is inevitable. With a lifetime’s worth of savings in your EPF account, you may be looking forward to a comfortable retirement. However, with limited savings in your account, funding your expenses after retirement can be tricky.

Investing smartly can help you generate wealth and help you earn income from your existing pool of savings. The best way to start is to invest the lump sum EPF savings amount in different high-yielding investment options.

Here are some meaningful ways to use your EPF money:

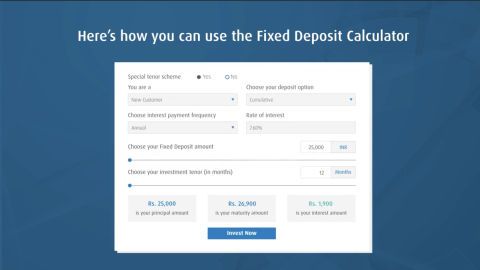

Invest in fixed deposits

Fixed deposits are the best investment avenues for individuals looking to multiply their EPF money. Here’s a look at some of the best advantages of investing in fixed deposits.

- Assured returns on your principal amount

- Get high-interest rates with stability

- Benefit from flexible tenor

- You can choose periodic gains

These investments are not affected by market forces, so your principal amount remains intact, and so there are no risks. Several company fixed deposits offer high rates of returns, online account management and options to start investing with just Rs. 15,000.

Invest in shares and mutual funds

Investing in market-linked securities like shares and mutual funds can help you gain from high-interest rates over a short period of time. Mutual funds offer you a rate of return up to 20% based on your portfolio.

These investment options are also highly liquid and let you exit your investment any time during the tenor. It is important to note that they operate on the market and fluctuate constantly and require close monitoring.

Since these are high-risk options, be sure to balance the risk with low-risk investments and ensure that you invest only a tiny part of your portfolio in shares and mutual funds. When investing to grow your savings, making a choice between mutual funds and fixed deposits can be difficult.

While mutual funds can accelerate the growth of your returns, fixed deposits ensure higher safety and stability. If you’re a risk-averse investor, fixed deposits are a better alternative to the risky returns from mutual funds.

Build a safety net using SCSS

Senior Citizens Savings Scheme (SCSS) is an investment option customised for you post-retirement. It offers you an interest rate of up to 7.4% and involves investing for 5 years. You can further renew your SCSS for 3 more years. You can invest a sum ranging from Rs. 1,000 to 15 lakh. This is a stable investment option that is free from the influence of market forces and is backed by the government. Here, you can either open one or many single accounts or a joint account.

Use it to invest in real estate

This is a great investment option that offers you a high rate of return. Besides, investing in real estate can also be used to hedge against inflation. This form of investment also gives you more flexibility. You can purchase one or more residential or commercial properties and put them on rent. You also have the option of letting your investment in a property grow over time and then selling it when the property prices are high enough. As a thumb rule, ensure that you pick a recent property in an area that has good growth prospects.

Investing your EPF money in a profitable combination of these options can easily help you finance post-retirement life. By choosing the right mix of investment options, you can craft a sound investment portfolio that offers you the stability of income and financial growth for your entire retirement period.

| Types of Investment | ||

| Fixed Deposit | PF | Mutual Fund |

| Senior citizen savings scheme | Company Fixed Deposit | Post Office FD |

| National Pension Scheme | Certificates of Deposit | Monthly Income Scheme |

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply