Fixed deposit and savings accounts are safe instruments for parking surplus funds, as these offer guaranteed returns. However, when it comes to growth of your funds, a fixed deposit offers higher interest rates and flexibility.

Here are 6 reasons why investors prefer FDs to savings account.

1. Attractive rate of interest

You can earn more with high FD interest rates by investing in a fixed deposit. Even with a short-term deposit of a few months, you can earn more than what you could if you left your money in a savings account. It can also help you beat inflation, which erodes the purchasing power of your money, as you can accelerate the growth of your funds.

2. No effect of market fluctuations

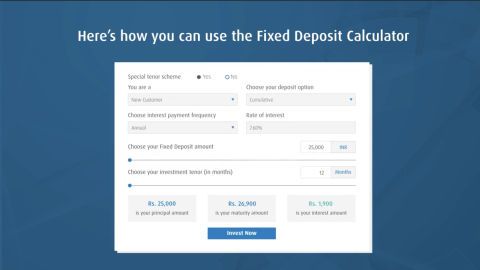

The returns of your fixed deposits remain unaffected by market fluctuations, so your hard-earned money remains safe. You can also use fixed deposit calculator to determine your returns before you even start investing. This could help you plan your finances better, so you have a clear roadmap on how to grow your savings.

3. Interest rate benefits for senior citizens

A savings account generally offers the same rate of interest for everyone, irrespective of their age. However, when it comes to a fixed deposit, senior citizens get higher interest of anywhere upto 0.25% per annum. Thus, fixed deposit can go a long way in providing you with the much-needed financial support, so you can enjoy your post-retirement years.

Additional Read: 6 Common mistakes to avoid, while investing in FDs

4. Gain from periodic interest payouts

Unlike savings accounts, a fixed deposit can help you gain periodic interest payouts so you can plan your expenses as per your convenience. Periodic interest payouts are most helpful in your post-retirement years when you need monthly income for catering to your regular expenses. If you are looking for regular interest payouts, you can choose a non-cumulative FD by selecting monthly, quarterly, semi-annual or annual payouts. Else, you can choose a cumulative FD which gives you the total interest earnings at maturity.

5. FD promotes the habit of savings

Fixed deposits have a fixed lock-in period, which limits the unnecessary withdrawal of your money until maturity. A savings account, on the other hand, enables you to withdraw any amount at any time, which proves detrimental to your goal of wealth appreciation.

As you are limited from easy access to your money, you end up saving more. This helps you benefit from the power of compound interest, which adds your earnings to your principal and helps you earn more money.

For those looking to lock into attractive FD interest rates, investing in a Bajaj Finance online FD can be a great option. You can reap the benefit of an end-to-end online paperless process that enables you to invest from the comfort of your home, with minimum hassle and documentation.

6. FD can be tailored to your needs

A savings account offers very little options to account holders. There are no variations in savings accounts and with the uniformity in interest rates, opening a savings account in one bank is just as good as opening it another bank. However, an FD can be of many types to suit your individual needs.

For example, those who seek monthly income post-retirement can opt for periodic payouts. This helps them fund their expenses after they retire, without denting into their savings.

For those who seek to invest a lumpsum amount, can choose to invest in the regular fixed deposit, where you can invest as per your convenience. You can also choose to ladder your deposits, to maximise liquidity and tailor your FD as per your goals.

Additionally, those who choose to save monthly, can choose to save with Systematic Deposit Plan – a monthly FD option that helps you start saving with just Rs. 5000 per month. You can choose to make 6 to 48 deposits that are FDs on their own. You can choose tenors of 12 to 60 months for each of your deposits, depending on your own convenience.

As you can see, your potential to maximise your wealth and choose the option most suited to you is much more in an FD as compared to a savings account. Achieve financial freedom by investing in a fixed deposit that offers you high interest with utmost safety.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply