Savings are the key to a healthy financial life. The only thing that trumps saving is investing the money that you save. This allows you to grow your wealth and develop a corpus that you can use to finance future needs. To invest wisely and keep expenditure to a minimum, it is crucial to know how you can save on taxes while investing. Choosing investments that help you do so under Section 80C of the Income Tax Act is how to ace this goal.

Here are 7 investments that can help you and your family save tax:

Public Provident Fund (PPF)

Being a long-term scheme backed by the government, PPF investments are not only beneficial for tax saving, but also guarantee returns. Despite these investments having a lock-in period of 15 years, premature withdrawals are allowed after 7 years. Both salaried and non-salaried Indian residents can apply for this scheme. Not only do you receive 7.6% interest per annum, but the interest is also tax-free. Furthermore, investing is made easy with a minimum investment of Rs. 500 and a maximum limit of Rs. 1.5 lakh.

Employee Provident Fund (EPF)

Salaried employees can invest in their retirement while saving taxes with an EPF. This investment is hassle-free as your employee automatically deducts 12% of your basic salary apart from Dearness Allowance while contributing the same amount from their end towards your provident fund account each month. Any employee earning more than Rs. 15,000 basic salary a month can open this account. Furthermore, if you quit your job and do not join another employer within the next two months, you can withdraw your PF amount.

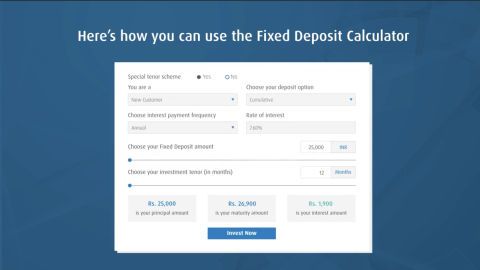

Fixed Deposit (FD)

Investing in a fixed deposit can help you earn guaranteed returns. Not only can you claim Fixed Deposit tax exemption under Section 80C of the Income Tax Act, you can also take a loan against your Fixed Deposit when in need. In order to get the best interest rates, it is essential to consider investing in company FDs. For instance, while most banks offer around 4-6% interest on Fixed Deposits, the Bajaj Finance Fixed Deposit gives you one of the highest interest rates in the market.

National Pension System (NPS)

This investment was started by the government for all individuals between 18–60 years of age to plan finances for retirement. This scheme also permits partial withdrawal after 15 years in special circumstances. There is no limit on the maximum contributions towards this scheme and the employer’s contributions are tax-free. You can invest and claim tax deductions on the same on an amount up to Rs. 1.5 lakh under Section 80C.

Unit Linked Insurance Plans (ULIP)

This investment scheme is eligible for tax deductions up to Rs. 1.5 lakh under Section 80C. The investment is based on a mixed balance of insurances and investments in the stock market. You can buy ULIP for yourself, your spouse, or even your child. While there is no limit on the maximum contribution amount towards this scheme, it is important to remember the interest varies as per market conditions.

Life insurance

You can now save on taxes while investing in life insurance, under Section 80C of the Income Tax Act. Furthermore, you can do this for not only yourself but your spouse and child too. You can also claim premiums paid for any family member beyond your spouse and child if you are an HUF (Hindu Undivided Family). It is important to remember that you can claim deductions only if your premium amount is at least 10% less than the promised amount. It is also essential to check if the insurance provider is listed under IRDAI (Insurance Regulatory and Development Authority of India).

Sukanya Samriddhi Yojana

The government specially crafted this scheme to create benefits for the girl child in India. You can open this account for your daughter before she reaches 10 years of age. If you are a guardian of the girl child, you can still do the same. The maximum investment limit in a financial year is Rs. 1.5 lakh. The invested amount, along with its maturity amount and withdrawals, are all tax-exempt. In addition to this, you can withdraw up to 50% of the amount once the girl child reaches 18 years of age.

So, choose your investments wisely and save tax under Section 80C.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply