What is the Bajaj Finance FD calculator?

When you invest in a fixed deposit, you lock-in your investment for a fixed period. Using the Bajaj Finance Fixed Deposit Calculator, you can easily find out the maturity amount and interest earned when you invest in a Fixed Deposit.

FD calculators are a useful financial planning aid to assist your decisions in how much capital investment will yield you a particular amount on maturity. It is most helpful to know how you can fulfil a financial obligation and after what duration the money will be available to you. You can use this calculator to know when to invest and plan your spending accordingly.

With a simple and user-friendly interface, you can plan the amount of money you should invest to get stable returns. This can help you gauge your yield over your chosen tenor.

How to use the Bajaj Finance FD calculator?

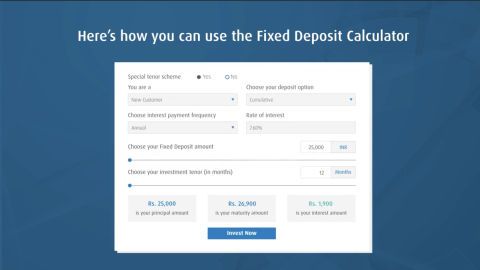

Using the Bajaj Finance Fixed Deposit Calculator is easy. All you have to do is follow these steps:

- Select your customer type. For example, whether you are a new or existing customer or a senior citizen.

- Choose whether you want a non-cumulative or cumulative FD.

- Enter the fixed deposit amount that you wish to invest, along with the tenor.

Once this is done, you will automatically see the interest and maturity that you will gain.

Additional Read: Using Bajaj Finance FD calculator for retirement planning

Applications of the Bajaj Finance Fixed Deposit calculator

Calculators are handy tools that enable an investor to calculate and gain clarity on various aspects like the interest rates, the tenor and even the maturity. Here are some of the top uses of fixed deposit calculators:

- To gain insight about the interest rates: These calculators showcase a range of various interest rates for different tenor. This provides the investor exposure to the range of interest rates offered on the FD. Knowledge of this can help an investor get an estimate of rates that the investment would be applicable to.

- For understanding the range of tenor options: The tenor for a fixed deposit ranges from 12 months to 60 months. By using a calculator, an investor can speculate the various lengths of tenor and the maturity for the various tenors available. This can help you in deciding the period over which you want your investment to grow.

- To figure out the range of principals that can be invested: The principal amount is the amount that you invest in FD. Using the calculator can show you the minimum and maximum range of sums that the financial institution allows you to invest. It also lets you see the interest rates for that amount and the maturity.

- To calculate the maturity of your investment: This is the primary use of the calculator. Its main aim is to show you the overall maturity of your invested amount over the period of the tenor.

- Understand the difference between Cumulative and Non-cumulative options: You can choose these variants and see your overall returns. In a cumulative option, you will receive a lumpsum after the maturity and for non-cumulative FDs you can look at the fixed interval pay out. There will be a slight lowing of the overall interest earned in a non-cumulative option.

Bajaj Finance FD calculator shows the amount of interest you would have received at the end of the tenor; the amount of money you would make either periodically or at end of the tenor, depending on whether your FD is non-cumulative or non-cumulative. Thus, you can choose the option that is best for you.

Additional Read: Short-term or long-term FD: Which FD is best for you?

Additional features of Bajaj Finance FD to aid your investment

- Auto-renewal – This is a great option to ensure you do not miss out on the prevailing high interest rates with Bajaj Finance. In an economy with interest rates going low, it is a smart move to lock-in your FDs at higher rates rather than wonder on the next rate movement.

- Debit card – A debit card can now be used for a better purpose than just spending. In select locations, you can easily create an FD with Bajaj Finance using your debit card.

- Multi-deposit facility – This is an easy to use and beneficial feature wherein you can create multiple FDs using one lumpsum investment amount. You can break the lumpsum into various amounts and choose different tenors. In case of urgent need for liquidity, you can also withdraw a single FD without affecting the returns on other FDs.

- Loan against FD – Liquidity should not come at the cost of earning high returns. Bajaj Finance has kept exactly that in mind and provided an option to avail of a loan against fixed deposit. You can use the monthly returns from your FD to pay a small portion of your loan EMI, thus reducing your loan repayment amount.

Using the Bajaj Finance Fixed Deposit Calculator, you can easily choose from a range of tenor and principal amounts available. It can help you take a decision about how much you should invest in Bajaj Finance Fixed Deposits.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply