It is imperative that you choose a credit card wisely. Depending on the customer’s lifestyle and spending pattern, the right credit card can offer a wide range of benefits while enabling the cardholder to save more on their purchases. Financial institutions today provide multiple types of credit cards tailored for different lifestyles. You must compare different types of credit cards available in the market and choose a card that fits your lifestyle and spending habits. This way, you can be assured of getting the most out of your credit card, either through reward points, cashbacks and discounts, or other co-branded benefits.

Best credit cards in 2021

Credit card name |

Joining fees |

Annual fees |

Platinum Choice SuperCard |

Rs. 499+GST |

Rs. 499+GST |

Platinum Choice First Year Free SuperCard |

Nil |

Rs. 499+GST |

Platinum Plus SuperCard |

Rs. 999+GST |

Rs. 999+GST |

World Prime SuperCard |

Rs. 2,999+GST |

Rs. 2,999+GST |

World Plus SuperCard |

Rs. 4,999+GST |

Rs. 4,999+GST |

Travel Easy SuperCard |

Rs. 999+GST |

Rs. 999+GST |

Value Plus SuperCard |

Rs. 499+GST |

Rs. 499+GST |

Platinum ShopDaily SuperCard |

Rs. 499+GST |

Rs. 499+GST |

For instance, while some issuers may promote the best credit card in India with no annual fees, others waive off the joining fees when your annual spending meets a threshold amount. What’s more, you can find a credit card tailored to your profession or spending habits too, like a fuel card, a travel card, a doctor’s card and more. However, you may be looking for an all-rounder or the best free credit card in India. Fortunately, with some research, you can successfully choose the best credit card in India that matches your needs.

Take note of the following pointers when comparing top credit cards in India.

Which bank credit card is best?

Issuers offer different types of credit cards that are tailored to meet specific needs. For instance, a fuel card provides a surcharge waiver and gives you extra reward points on refuelling your motor vehicle. On the other hand, a shopping card extends attractive discounts, cashbacks, and rewards when you use it to pay for groceries, lifestyle, and other related expenses. If you have a specific spending habit, your best bet would be to avail of a card that meets your needs.

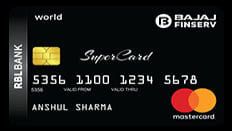

However, if you don’t, the best credit card for you would be the one that offers rewards and discounts on each or most transactions. The Bajaj Finserv RBL Bank SuperCard is one such card that offers reward points on every transaction you make using it. From travel booking to hotel stays, from paying for fuel and appliances to gadgets, clothes and groceries, you can use this credit card to pay for any expense and enjoy amazing discounts, rewards, and offers that give you maximum bang for your buck.

Choose a credit card that lets you withdraw cash at nominal charges

Though credit cards are widely accepted, you still need cash, which leaves you no option in certain places but to withdraw some money using your credit card. When you do this, the issuer charges a processing fee plus high interest on the transaction amount, which adds to your expenses. But with SuperCard, you can withdraw the required cash from ATMs across the country, and you don’t have to pay any interest for 50 days. This way, you can meet your need for emergency cash without paying any cost. Look for a credit card that offers you a similar advantage, so keep your costs low.

Choose a credit card that offers a low-cost emergency loan

In addition to allowing ATM cash withdrawals, good credit cards in India also offer emergency loans in times of need. You can avail of this by converting your credit limit into a personal loan. You then repay the borrowed sum along with interest to the lender. However, this too attracts high interest, which adds to debts. Fortunately, you don’t have to pay interest for 90 days when you avail of an emergency loan with a SuperCard. This way, you can either repay the loan within the interest-free period at no cost or do it by converting your loan into three easy EMIs.

Choose a credit card that allows you to make big-ticket purchases on EMI

While all credit cards boost your purchasing power by allowing you to make big-ticket purchases on credit, only certain good credit cards in India offer an EMI option. Without this option, repayment becomes burdensome as you may have shopped for multiple appliances during the same billing cycle during the festive season. Not repaying the entire sum spent may lead to high-interest penalties.

Thankfully, with the SuperCard, you enjoy EMI financing option and discounts on purchases that you make from Bajaj Finserv partner stores. Additionally, you get a 5% cashback when using your reward points to make the down payment. This not only makes for delightful purchases but also easy repayment.

Now that you know how to choose the best credit card in India and the features that make the SuperCard one of the top credit cards in India, apply for one today. To get started, check your pre-approved offer from Bajaj Finserv to benefit from a customised deal and enjoy one-step hassle-free online approval. Once approved, you can unlock the many benefits that SuperCard offers.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply