GST subsumes erstwhile state taxes like VAT, octroi, luxury tax, purchase tax, and central taxes like customs duty, central excise duty and service tax. Now, under the one-nation, one-tax regime, a simple 3-fold breakup has been formulated, allowing the centre and states to levy taxes. Currently, the types of GST in India are CGST, SGST, and IGST. This simple division helps distinguish between inter-state and intra-state supplies and mitigates indirect taxes. To learn more, read about these three different types of GST.

What is SGST or State Goods and Service Tax?

SGST is the tax that the state government levies on intra-state goods and service transactions. SGST subsumes earlier taxes such as VAT, entertainment tax, luxury tax, octroi, tax on lottery, and purchase tax. UGST or Union Territory Goods and Service Tax replaces SGST in union territories like Andaman and Nicobar Islands or Chandigarh.

What is CGST or Central Goods and Service Tax?

The central government levies GST on intra-state goods and service transactions. The central government collects the revenue generated through Central Goods and Service Tax (CGST). It is levied along with SGST or UGST, and revenues are shared between the state and the centre.

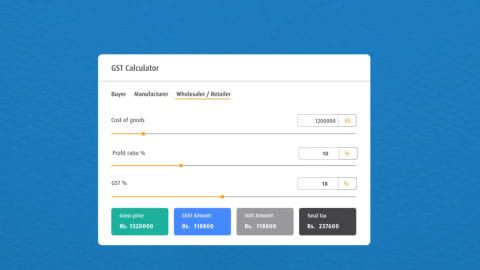

For example, if you are a Bengaluru-based dealer and are selling to another dealer in Bengaluru since it’s an intra-state sale, both CGST and SGST will be applicable on this transaction. If your transaction of goods is worth Rs. 30,000, and it attracts 18% GST, then 9%, which is Rs. 2,700 of the tax amount, is collected as SGST by the state government, and a matching amount is collected as CGST by the centre.

What is IGST or Integrated Goods and Service Tax?

Integrated Goods and Service Tax is the tax levied on inter-state goods and service transactions. It applies to imports and exports as well. Under IGST, the taxes charged are shared by both the centre and state. The SGST part of the tax goes to the state wherein the goods and services are consumed.

IGST also helps you claim Input Tax Credit. It’s a facility that checks cascading tax and allows business owners to save at every stage of the supply chain.

In addition, you can now make your supply chain even more efficient by accessing sufficient working capital through a collateral-free Bajaj Finserv SME Loan. You can boost your supply chain efficiencies today when you check your pre-approved loan offer. Doing so gives you instant approval through a customised deal.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply