Fixed deposits (FDs) have long been a popular investment option for many investors, particularly senior citizens. It is because FDs are fixed investment tools and are not affected by market forces. They provide a steady rate of returns, and the risk of losing your capital is also reduced to a great extent.

However, the steady returns from FDs mean that they are taxable. The income from your FDs is added to the rest of your income under the heading ‘Income from Other Sources’ and is taxed at the same rate. Banks deduct the ‘tax deducted from source’ (TDS) for the interests on FDs when it is accrued.

How is income tax on FD interest rate calculated?

As mentioned, you have to add your interest earned to your total income and calculate your tax liability. You can match that with the yearly TDS deduction that your bank makes. Even if it hasn’t been deducted, you need to pay tax on your total income that includes your interest earned.

Remember, it is recommended to pay tax on the interest earned yearly. If you wait till the maturity of your FD to pay your taxes, you may have to pay higher taxes. Your Form 26AS will contain all the details of the TDS deducted on any of your sources of income.

To understand the calculation better, consider the following example:

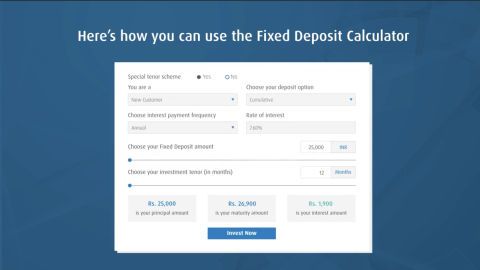

Let’s say that you fall under the 20% tax bracket and you have 2 FDs of Rs. 2 lakh each for 3 years at 8% p.a. In the first year, your return interest comes to Rs. 1,600 each for the 2 FDs, and your total interest will be Rs. 32,000. Now, your bank will deduct TDS at 10% of interest, which for these two FDs combined will come up to Rs. 3,200. Now, based on your income tax bracket you will have to pay 20% of the interest earned annually, which will come to be Rs. 6,400. Since the TDS has already been deducted, the total balance amount you will have to pay is Rs. 3,200. You can use an FD calculator online to calculate returns.

Additional Read: How you can invest 10 lakh to maximize monthly interest ?

When is income tax paid on the interest earned?

The income tax needs to be paid before 31st March, i.e., before the end of the financial year. You may also be liable to pay quarterly advance tax if you have a large income from interest. Remember to link your PAN card to your bank account to avoid the 20% TDS that is deducted otherwise. If your PAN card is linked, only 10% TDS is deducted.

You are eligible for tax deductions if your FD rates come to less than Rs. 10,000. If your interest income is less than Rs. 10,000, banks won’t deduct TDS. Moreover, when your total income is less than Rs. 2,50,000, you can provide the 15G and 15H Forms to avoid TDS.

Read this to save tax on FD interest.

However, under Section 80TTB of the Income Tax Act in the 2018 Budget, the interest income to avoid deduction has been raised to

Rs. 50,000 for senior citizens. This means that the TDS will not be deducted from senior citizens who earn less than Rs. 50,000 as bank FD interest. Thus, FDs are a good source of steady income, even though they are taxable.

FD TDS for different customers

a. For Indian citizens: The TDS on interest earned by Indian residents on fixed deposits in the fiscal year 2021–2022 will be 10%.

b. For NRIs: On interest earned on fixed deposits, NRIs are required to pay a TDS of 30% plus any applicable surcharges and taxes.

c. Under Section 194A, senior citizens (individuals 60 years of age and above) and others are eligible for exemptions from TDS on FD interest gains up to Rs. 50,000 and Rs. 40,000, respectively.

d. According to the Income Tax Act of 1961, FD interest earned exceeding Rs. 5 lakh or Rs. 10 lakh is entitled for additional tax deductions of 10% and 20%, respectively, in addition to TDS.

How much amount of FD is tax free?

When investing in fixed deposits, an investor is eligible to claim an income tax exemption on investments up to Rs 1.5 lakh. Interest earned on a Tax Saving Fixed Deposit is taxable and is taken out at source. For tax-saving FDs, there are no early withdrawal, loan, or overdraft (OD) options available.

How is TDS calculated on FD?

If the interest income in any given fiscal year exceeds the predetermined limits, TDS is applied. In a fiscal year, banks deduct TDS at a rate of 10% from the interest generated on FDs. When your interest payments in a fiscal year exceed Rs. 40,000 and your income is not exempt, this amount is solely deducted.

If your interest income for the year is less than Rs. 50,000 and you are a senior citizen (someone who is 60 years of age or older), no TDS is due. According to Section 195 of the Income Tax Act, TDS is deducted at a rate of 30% from the interest generated on FDs for NRIs, or Non-Resident Indian investors (1961). The deduction also includes surcharge and cess.

How can I save TDS on FD?

To avoid incurring TDS on your FD, simply fill out the Form 15H in your bank. Non-senior citizens who have total taxable incomes below the basic exemption threshold of Rs. 2.5 lakh can also fill out Form 15G to prevent TDS from being deducted from their fixed-income investments.

Know More About Bajaj Finance Product |

||

| Types of Fixed Deposit | ||

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply