Wealth creation is a slow process and starting early investments in the right options can put you financially ahead by years. However, with the plethora of investment options available, choosing the right one is a challenge. It is wise to sort options based on risk appetite, that is why fixed deposits and mutual funds are the top favourites of Indian investors.

Fixed and mutual funds enable investors to grow their savings effortlessly with different benefits. Hence, before choosing where to invest, it is best to know in detail about these investment avenues.

Let us have a look at these two options in detail:

What is a fixed deposit (FD)?

A fixed deposit is one of the safest and most stable investment options assuring good returns on your deposit. With a fixed deposit, you can deposit a lumpsum that accrues a fixed interest over a predetermined tenure. This financial instrument remains unaffected by external market influences, thus, making it one of the most trustworthy financial tools to invest in.

Features of fixed deposit

a. Secured returns: With fixed deposit you can earn secured returns on your investment as the FD rates is fixed and you receive the principal amount back along with the interest earned during the tenure. With Bajaj Finance FD you can get FD rates of up to 7.30%.

b. Low risk: One of the advantages of fixed deposits is that their interest rates are not impacted by market volatility, making them a safe investment option.

c. Additional rate benefit for senior citizens: Seniors profit from fixed deposit accounts more than other people since they offer a high rate of interest on fixed deposits. (up to 0.25% higher interest rate)

d. Flexibility: Fixed deposits give you the option to receive interest on a recurring basis. Here, you have the choice of selecting either monthly, quarterly, half-yearly, or yearly interest, depending on your demands, or you may use the cumulative method and earn a lump payment when the loan is paid off.

What are mutual funds?

Mutual funds are the financial instruments of a portfolio of stocks, bonds, equities, and other market-linked instruments or securities. Several investors pool together to invest in mutual funds with a common goal of increasing their savings. After deducting the expenses incurred, the total income earned through these investments is equally distributed among investors.

Features of mutual funds

• Managed by professional: A mutual fund is managed by professionals. Before investing in any securities or instruments, the fund managers conduct in-depth research and analysis. They keep an eye on the performance of the portfolio after investing.

• Investment diversification: A mutual fund's diversity is well known. It makes investments in a range of securities and instruments across numerous businesses and sectors. Diversification lowers the risk in the portfolio.

• Affordable: Given that the portfolio is distributed to investors in numerous units, mutual fund shares are more affordable than individual equity investments.

• High liquidity: A mutual fund is a liquid investment that can be easily sold at any time, with certain redemption costs, and the shares will be sold at the current net asset value (NAV).

Difference between a fixed deposit and mutual funds

Particulars |

Debt funds |

Fixed deposits |

Rate of returns |

7%-9%* |

6%-9%* |

Dividend option |

Yes |

No |

Risk |

Low to moderate |

Low |

Liquidity |

High |

Low |

Investment option |

Can choose either a SIP with monthly payments or a lumpsum investment |

Can only opt for a lumpsum investment |

Early withdrawal |

Allowed with or without exit load depending on the mutual fund type |

A penalty is levied upon premature withdrawals depending on financiers |

Investment expenditure |

A nominal expense ratio is charged |

No management cost |

When you go to a public sector, private bank or a Non-Banking Finance Company (NBFC) to open an FD, you are informed about the interest rate it will fetch on maturity in advance. The mentioned interest rate cannot be altered or changed when you open an FD and stay the same throughout the tenure.

Although your interest in mutual funds may be higher than in fixed deposits, there is no assurance that this will remain constant. Mutual funds are typically dependent on market movements and there is always a risk of capital loss too. So unlike fixed deposits, gains in mutual funds are not continuous or uniform. Equity mutual funds are subject to volatility in the stock market; thus, every mutual fund comes with the subject to market risks.

Whether you want to invest in a mutual fund, or a fixed deposit is ultimately dependent on your risk appetite.

Debt mutual funds v/s Fixed Deposits

Those seeking a safe, low-risk investment can easily invest in the Bajaj Finance Fixed Deposit offering stable and assured returns with the best FD interest rates. With such attractive rates and suite of benefits the Bajaj Finance Fixed Deposit is an ideal investment tool for those looking to grow their savings.

With the highest safety ratings of CRISIL AAA/STABLE and [ICRA]AAA(Stable), Bajaj Finance is one the safest FD issuer for you. You can also reap the benefit of lucrative interest rates and the flexibility to invest from the comfort of your home.

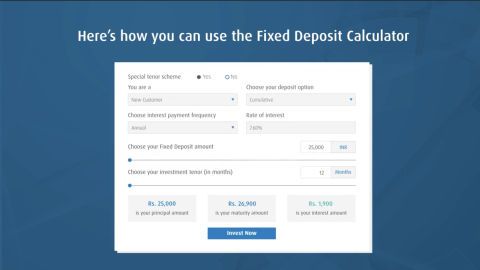

Make a smart investment choice with a Bajaj Finance Fixed Deposit and start investing with just Rs. 15,000. You can easily calculate your returns by using an FD calculator.