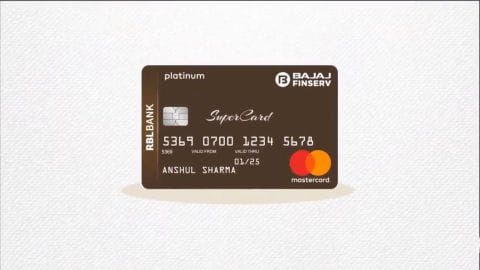

Features of the Shop Smart SuperCard

-

Welcome rewards

Get a Rs. 500 gift voucher on spending Rs. 2,000 within 30 days of card issuance

-

Offer on movie tickets

Get 1+1 movie tickets on BookMyShow (any day of the month, up to Rs. 200)

-

Airport lounge access

2 complimentary domestic airport lounge access in a year

-

Cashback on grocery shopping

5% cashback on grocery spends (up to Rs. 250 per month)

-

Annual savings

Savings of up to Rs. 9,400 annually

-

Annual Fee waiver

Spend Rs. 50,000 in a year and get the next year’s annual fee waived off

-

Interest-free cash withdrawal*

No interest on cash withdrawals for up to 50 days

-

Emergency advance*

Convert your available cash limit into a personal loan for 90 days with zero processing fee and an interest rate of 1.16% per month

The Bajaj Finserv RBL Bank Shop Smart SuperCard is loaded with features to meet all your daily and monthly credit needs. It is a great addition for avid shoppers, especially considering its range of benefits. For instance, as part of the welcome kit, you get a gift voucher worth Rs. 500 by simply paying the joining fee and shopping worth Rs. 2,000 in the first 30 days of card issuance.

What’s more, this SuperCard can also lend itself to your other financial needs. If you’re facing a cash crunch, you can get an emergency advance or withdraw interest-free cash from ATMs.

A processing fee of 2.5% of the cash withdrawn amount or Rs. 500 + GST (whichever is higher, is applicable)

*The loan is provided by RBL Bank as per their discretion and is subject to its policies.

| Benefits | Value earned (Rs.) |

| Welcome gift: Gift vouchers worth Rs. 500 (no welcome rewards are given for the first year free card variant) | 500 |

| 5% cashback on grocery spend (up to Rs. 250 per month) | 3,000 |

| BookMyShow offer: 1+1 movie tickets on any day of the month (up to Rs. 200) | 2,400 |

| 2 complimentary domestic airport lounge access in a year | 3,000 |

| Spend based waiver: Spend Rs. 50,000 in a year and get an annual card fee waiver | 500 |

| Total benefits per annum | 9,400 |

Eligibility criteria

-

Nationality

Indian

-

Age

21 to 70 years

-

Employment

At bank’s discretion

-

Credit score

At bank’s discretion

What are the eligibility criteria for getting a credit card?

Our partner bank has easy to meet eligibility criteria to apply for the credit card. These include:

- Age should be within 21 to 70 years

- Nationality should be Indian

- Applicant must fulfil the income and credit score criteria set by bank

How to apply for a SuperCard

Applying for the Bajaj Finserv RBL Bank SuperCard is quick and easy:

- 1 Click here and enter your mobile number

- 2 Submit the OTP you’ve received and check if you have a credit card offer

- 3 If you have an offer, please avail of the offer

- 4 Get a call from our representative

Fees and charges

The following are the charges applicable on the Platinum Choice SuperCard:

| Type of fee | Charges applicable |

| Joining fee | Rs. 499 + GST |

| Annual fee | Rs. 499 + GST (fee waiver on annual spends of Rs. 50,000) |

| Add-on card fees | NIL |

| Cash payment at branches | Rs. 100 cash deposit transaction done at RBL branch and Bajaj Finserv branch effective from 1st July 2022 |

| Surcharge on purchase/ cancellation of railway tickets | IRCTC service charges* + payment gateway. Transaction charge [Up to 1.8% + GST of (ticket amount + IRCTC service charge)] |

| Fuel transaction charge - for transactions made at petrol pumps to purchase fuel^ | 1.00% + GST surcharge on fuel transaction value of Rs. 10 + GST, whichever is higher Fuel surcharge will depend on the merchant and it may vary from 1% to 2.5% |

| Reward redemption fees | A reward redemption fee of Rs. 99 + GST will be levied on all redemptions made on Bajaj Finserv RBL Bank co-brand credit card. T&C apply |

| Cash advance transaction fee | 2.5% of the cash withdrawn amount or Rs. 500 + GST (whichever is higher, is applicable) |

| Over-limit penalty ^^ | Rs. 600+ GST (w.e.f Oct 9, 2023) Higher of 2.5% of overlimit amount or Rs. 500 + GST |

| Finance charges (retail purchases and cash) | APR up to 3.99% + GST p.m. (up to 47.88% + GST p.a.) |

| Card replacement (Lost/ stolen/ reissue/ any other replacement) | NIL |

| Duplicate statement fee | NIL |

| Cheque return/ dishonour fee auto debit reversal-bank account out of funds | Rs. 500 + GST |

| Dynamic Currency Conversion Fee Markup + | 3.5% of the transaction amount + GST |

| Merchant EMI transaction*** | Rs. 199 + GST per merchant EMI transaction |

| Rental transactions | 1% fee on the transaction amount will be levied on all rental transactions done on any applicable merchant |

Late payment charges

| Late payment fee | |

| 12.5% of the outstanding amount | |

| Minimum Rs. 5 | Maximum Rs. 1,300 |

All the above charges are subject to change under various organisational policies. However, the cardholder will be duly informed about the changes.

*Refer to the IRCTC website for details.

^The surcharge is applicable on a minimum fuel transaction of Rs. 500 and a maximum of Rs. 4,000. Maximum waiver is Rs. 100.

***The charges are applicable per merchant EMI transaction, i.e. EMI conversion done at the time of transaction through credit card at merchant outlet/ website/ app.

EMI transactions will not accrue base reward points.

^^Here “Overlimit Amount” is the difference between the Overlimit outstanding amount and the assigned credit limit (Only If OVL consent is provided in MyCard). There will be no upper limit capping.

+ Dynamic currency conversion fee will be applicable for each international transaction performed in Indian currency at an international location or transactions performed in Indian currency with merchants located in India but registered overseas.)

Frequently asked questions

This SuperCard offers EMI facilities, interest-free ATM withdrawals*, emergency advance*, and attractive deals. The benefits of the card go beyond the usual credit card offering and hence, it is known as a SuperCard.

A processing fee of 2.5% of the cash withdrawn amount or Rs. 500 + GST (whichever is higher, is applicable)

*The loan is provided by RBL Bank at their discretion and is subject to its policies.

The SuperCard acts as 4 cards in 1. It can be used as a credit card, a cash card, a loan card and an EMI Card. Due to unique features like these, it has been named as ‘SuperCard’.

When you withdraw cash from ATMs with a SuperCard, you don’t have to pay interest for up to 50 days. You only pay a 2.5% or Rs. 500 (whichever is higher) + GST processing fee.

The SuperCard offers an emergency loan for 90 days*, once a year. The amount is based on your cash limit and has a nominal interest rate.

*The loan is provided by RBL Bank at their discretion and is subject to its policies.

There are many exclusive offers that can be availed at partner stores with the SuperCard. Apart from this, you can avail easy EMI financing* at most Bajaj Finserv partner stores to make purchases pocket-friendly.

With credit card, you get reward points worth Rs. 500 and a 5% cashback on grocery purchases.