Features of the Bajaj Finserv RBL Bank SuperCard

Bajaj Finance Limited has partnered with RBL Bank to provide feature-rich co-branded credit cards (SuperCard) loaded with attractive offerings. Its innovative and industry-first features not only help you manage your expenses but help you during emergencies.

Bajaj Finserv RBL Bank SuperCard has 16 different variants and comes with a host of benefits like:

-

Easy EMI conversion

Convert your shopping bills into affordable EMIs.

-

Interest-free cash withdrawals

Withdraw interest-free cash from ATMs across India for up to 50 days by paying a processing fee of 2.5% or Rs. 500 whichever is higher.

-

Up to 12X rewards points

Get up to 12X reward points on online spending.

-

Emergency advance*

Convert your available cash limit into a personal loan for up to three months at 1.16% per month with no processing fee.

Raise an online request with us

If you have any query related to Bajaj Finserv RBL Bank SuperCard, raise a request with us by visiting our customer portal – My Account. Once your request is raised, our customer service associate will reach out and solve your query within 48 business hours.

In a rare case scenario, you have not heard back from us within the committed timeline, you can also do a follow-up on your open request.

You also have the option to reopen a closed request if you aren’t satisfied with the resolution provided by our representative.

-

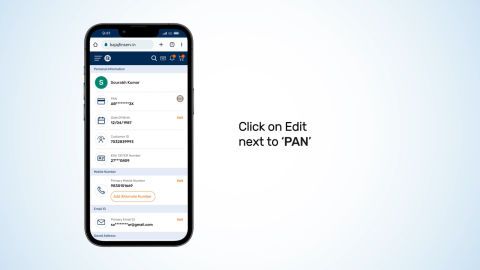

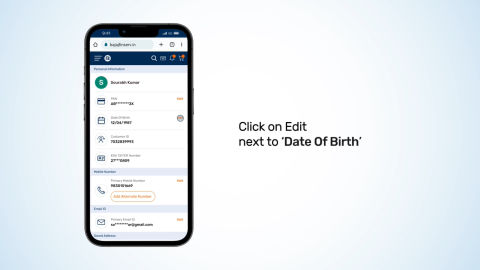

Raise your query on our customer portal - My Account

- Click on the ‘Sign-in’ button on this page to go to our customer portal.

- Sign-in with your registered mobile number and OTP.

- Enter your date of birth for verification and proceed.

- Select ‘Cards’ from the list of products.

- Choose relevant ‘Query’ and ‘Sub-query’ type and proceed to submit your request.

Alternatively, you can also click on the ‘Raise your query’ option below to visit My Account. You’ll be asked to sign-in. Once you’re signed-in, you can select your product, query, and sub-query type and proceed to submit your request.

-

Check pre-approved offers

Visit our customer portal – My Account to view offers on cards and loans.

Manage your Bajaj Finserv RBL Bank SuperCard

You can make payments, check card limit or view statement by visiting https://www.rblbank.com/auth-controls.

These online services make it easier for you to manage your SuperCard.

In case you need any assistance, you can call on +91 2271190900 or write to supercardservice@rblbank.com to connect with the RBL Bank customer representative.

Frequently asked questions

If you wish to change your residential or office address for official communication, you can contact RBL Bank's customer care executives. You can call on +91 22 71190900 and raise a request with them.

Note: In case you have raised any change in your residential address, you have to submit your address proof within three months at kyc.cards@rblbank.com.

This card offers you an interest-free cash withdrawal facility. This means that you can withdraw from any ATM across India without any interest for up to 50 days. You only need to pay a processing fee of 2.5% or Rs. 500 whichever is higher, will be applicable.

Note: The amount you can withdraw is subject to bank policies and the limit assigned on your Bajaj Finserv RBL Bank SuperCard.

You can redeem your reward points on various categories like travel, shopping, voucher, mobile recharge, etc. You can visit the rewards and savings section on the RBL Bank rewards portal for redemption.

You can contact RBL Bank's customer care at +91 22 71190900 and raise a change request through your registered mobile number.

To update your mobile number or email ID, you can contact RBL bank's customer care executives at +91 22 71190900 or write to supercardservice@rblbank.com.