Sumeet has been impressed by the features of Samsung’s latest flagship smartphone, the Galaxy S23 Ultra. Sumeet who is a graphic designer by profession is a technology enthusiast and does not want to miss an opportunity of having hands on the latest gadgets.

The versatile phone could be very useful for Sumeet in streamlining his work. With the help of the phone's stylus, he can take quick notes and design infographics on its large screen. Also, the device features a top-notch camera, a powerful processor, and a premium look. Sumeet wants to buy the phone, but the premium price makes him postpone the purchase.

Did you ever find yourself in a similar situation? You can hope of buying the Samsung Galaxy S23 Ultra or an iPhone, but the thought of spending a significant amount stops you from owning such devices. Here is where EMIs (equated monthly instalments) come into the picture.

EMIs allow you to convert a single purchase into smaller, manageable instalments spread across a fixed tenure. Monthly instalments help you avoid straining your finances while making it easy to manage your monthly budget. Now, let us understand what is EMI, how EMI is calculated, how does EMI work, and a lot more.

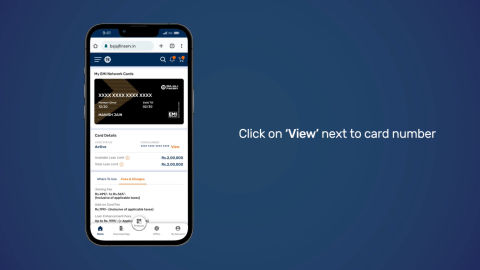

Apply for Bajaj Finserv Insta EMI Card

Understand your EMIs with amortisation schedule?

To understand EMIs, you must first know about the loan amortisation schedule. An amortisation schedule is a table showing the details of each payment you make against the loan and displays how EMI works. It is provided to you after you purchase anything on EMI, as it helps borrowers understand the repayment structure.

Part of your EMI payment covers the interest charges, and the rest goes towards reducing the principal amount. Over time, the percentage of EMI that goes towards interest decreases, and the portion that goes towards the principal rises. The amortisation schedule informs you about the changes in principle and interest amounts and helps you see what your EMI payment for each instalments is.

Let us assume you want to buy a smartphone for Rs. 1,00,000. Instead of making a lump-sum payment, you opt for a more manageable route and purchase the device in equated monthly instalments. The EMI comes to around Rs. 17,254.84 per month (over six months).

In the first month, you pay Rs. 1,000 as interest, and the rest – Rs. 16,254.84 – goes towards the principal amount. This reduces your outstanding loan balance to Rs. 83,745.16. This process continues smoothly over the next five months. In the sixth month, you pay your last EMI of Rs. 17,254.84. You have finally paid off your loan in full, and the Samsung Galaxy S23 Ultra is entirely yours, with no outstanding EMIs.

While EMI undoubtedly eases your financial burden, there is a better alternative. An option that lets you purchase your favourite products without worrying about interest costs. The Bajaj Finserv Insta EMI Card is the answer. It enables you to buy your dream smartphone – or any other product – on No Cost EMIs. You only pay the product’s price, divided into easy EMIs, without additional interest. You can repay the cost of the product in EMIs, with flexible repayment tenures of up to 24 months.

Check Insta EMI Card Fees and Charges

Factors that affect EMI

When you take out a loan or purchase anything on EMIs, you agree to pay back the money you borrowed with interest over a set period. The EMI comprises two parts: the principle and the interest. The principal is the money you borrowed, and the interest is the amount you pay to the lender for borrowing the money.

- Principal amount: If the cost of the product is high, the loan amount is high as well, which increases the EMI amount.

- Interest rate: This is the cost of borrowing or purchasing a product on EMIs and is determined by the lender. A higher interest rate would increase raise your total EMI amount. Thus, looking for a lender offering a lower interest rate, or no interest rate can help reduce the burden.

- Loan tenure: This refers to the period over which you choose to repay the loan. A longer loan tenure results in lower EMIs, as the total payable amount is spread over more months. But this means you will pay more interest during the loan period.

Check Insta EMI Card Features and Benefits

How can you simplify EMI payments?

Even when you buy a big-ticket item such as the Galaxy S23 Ultra on EMIs, you might pay a substantial monthly amount. To simplify your EMI payments, you must purchase such items on No Cost EMI, where the interest is waived, and the EMI burden is reduced. All you need to pay is the principal amount, which is the cost of your product in EMIs. You can buy items on No Cost EMI using the Bajaj Finserv Insta EMI Card and divide the cost into monthly payments over 3-24 months.

This allows you to buy your favourite gadgets and devices without worrying about exceeding your monthly budget. The EMI you pay goes into repaying the principal component of the loan without attracting any interest.

EMIs serve as a comfortable bridge that allows you to purchase your favourite products, items, and much more without the pressure of paying the total amount upfront. They split the price tags of expensive items into manageable monthly instalments.

If you decide to take the EMI route, you can use the Bajaj Finserv Insta EMI Card. It allows you to shop for 1 million+ product on EMIs. You can also avail of a zero down payment facility, which is available on select models with the Bajaj Finserv Insta EMI Card. The digital card is accepted across all leading platforms and retail outlets, such as Amazon, Bajaj Mall, Flipkart, Croma, Vijay Sales, and more, making your shopping experience extremely convenient.