Any business owner or a self-employed professional associated with the purchase or supply of goods and services must file GST returns. If you belong to this category, you will have to make a GST payment based on the timeline for filing GST. Here’s what you need to know about your GST payment due and how to pay it.

What is GST payment?

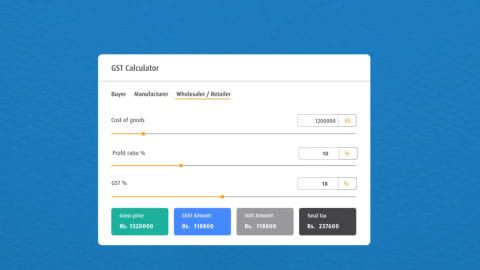

Deduce your input tax credit and subtract it from your outward tax liability to compute your total GST payment amount. To this amount, add the interest or late fee charges, if any and subtract the TDS/ TCS charges. This way, you will be able to arrive at the exact figure for your GST payment. After calculating the GST amount, proceed to pay it.

Additional Read: Know all about GST

How to pay GST online or offline

Step 1: As a regular taxpayer registered with GST, you can proceed to the official GST website to log in to your account.

Step 2: After your GST login, proceed to the ‘payments’ section listed under the ‘services’ tab. Here, select the ‘create challan’ option.

Step 3: Next, in the challan, enter every amount correctly under each head. Then, select the payment method.

Step 4: Once you fill in the particulars, under headers like CGST, IGST, CESS, among others, click ‘create challan’. In case of doubt, you can click the ‘save’ option and retain the challan for the future. This way, you can make as many changes as you want at any time to the challan through your registered account. Hit ‘create challan’ only when you are sure of the details you have entered.

Step 5: After the challan gets generated, you will have to proceed with the GST payment. Here you can choose from 3 options: make an over-the-counter payment at your nearest bank or make an online payment using net banking/ debit card/ credit card or make the payment via NEFT/ RTGS.

Step 6: You can carry out an online or offline GST payment based on your preferred payment method. In the case of online payment, as soon as the payment is made, you will get an acknowledgement to download the challan. When paying at your local branch, you will receive a printout acknowledgement. However, irrespective of how you pay GST, you will have to generate the paid receipt or final challan online. Retain a copy of your GST payment receipt; this will work as proof in future.

It is important to note that if your tax liability is more than Rs. 10,000, you must pay taxes online.

Additional Read: All about Goods and service tax identification number (GSTIN)

When can you make GST payment?

You will have to pay your GST every month after filing your GSTR 3B return. This means you will have to pay and file your return for the previous month by the 20th of the following month. Earlier, the payment coincided with GSTR 3 return, which stands suspended at the moment.

To avoid fines and interest charges, make total GST payments on a timely basis. If you delay the payment or pay lower than your dues, you will be charged 18% interest on your dues. That’s why set a reminder for yourself so that you never have to miss paying your GST on time.

GST payment forms

For dealers liable to pay GST online in India, the below GST payment forms are essential-

| Form GST PMT-01 | Maintains the electronic tax liability register |

| Form GST PMT-02 | Maintains the electronic credit ledger |

| Form GST PMT-03 | Includes order of rejection of the claim for refund of balance in electronic credit ledger/electronic cash ledger, issued by an authorised officer |

| Form GST PMT-04 | Use the form to communicate any discrepancy in your electronic credit ledger |

| Form GST PMT-05 | Maintains the electronic cash ledger |

| Form GST PMT-06 | Includes challan for payment of tax, interest, penalty, fees or any other amount |

| Form GST PMT-07 | Use the form to communicate if your bank account has been debited, but CIN has not been generated or CIN has been generated but not reflected on the GST portal. |

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply