The Indian government launched the Goods and Services Tax (GST) on 1 July 2017 to simplify India’s tax structure. The main aim of implementing it was one nation, one tax, one market. GST has replaced a dozen central and state-levied taxes such as excise, VAT, and service tax.

Business entities need to register under GST and obtain a unique 15-digit Goods and Services Tax Identification Number (GSTIN). This has replaced the Tax Identification Number (TIN) allotted to businesses by state tax authorities for registering under the VAT system.

Under GST, all registered taxpayers will be consolidated onto a single platform for compliance and administration purposes and will be registered under a single authority. More than 8 million taxpayers were migrated from various taxation platforms to GST.

What a GSTIN looks like

A unique code known as GSTIN is assigned to each taxpayer, which is state-wise and PAN-based. Here is what the 15-digit GSTIN indicates:

- The first two digits represent the state code according to the Indian Census of 2011. Every state or union territory has a unique code. For example, 27 stands for Maharashtra and 09 is for Uttar Pradesh

- The next ten digits are the PAN number of the taxpayer or business house

- The 13th digit indicates the number of registrations in a state for the same PAN. It is alpha-numeric (first 1-9 and then A-Z)

- The 14th digit is the alphabet ‘Z’ by default

- The last digit is a check code to detect errors. It can be an alphabet or a number

Why do you need a GSTIN?

GST registration is critical for business entities to avail various benefits available under the GST regime. The government has made it mandatory for businesses with an annual turnover exceeding Rs. 20 lakh to have a GSTIN. If you are a registered dealer, you need to file GST returns and pay if GST liability exists. Also, if the GST you pay is more than the GST liability, you can claim a refund through your GSTIN.

A GSTIN also helps when you are looking to avail a loan to fund your business. Financiers such as Bajaj Finserv provide business loans to buy inventory, expand commercial space and grow their trade. Your business should be registered with the Government of India and have a valid GSTIN to be eligible for a business loan.

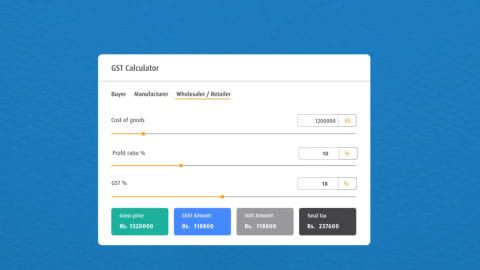

Additional read: How to calculate GST

GSTIN search and verification tool

If you have your GSTIN, you can verify any GSTIN with a single click on the GSTIN search tool, free of cost.

Benefits of the online GSTIN search and verification tool

- Checking for authenticity

- Easy verification

- Prevention against association with vendors using fake GSTINs

- Avoiding fraud

- Correction of any errors in reporting GSTIN

How to use the GSTIN search and verification tool?

- Enter a valid GSTIN number in the search box

- Click on ‘Search’

If the GSTIN entered is correct, you can verify the following details:

- The legal name of the business

- Date of registration

- State

- GSTIN status/ UIN status

- Constitution of business – company, sole proprietor or partnership

- Type of taxpayer – regular taxpayer or composition dealer

How to apply for a GSTIN?

Registering for GST and obtaining a GSTIN is free of cost. There are two ways for taxpayers to register under the GST system:

- Register online on the GST portal

- Visit the GST Seva Kendra set up by the Government of India

Applying online is the easier option. You can follow these steps to do so:

- Log on to this link, click on the ‘Services’ tab, hover over ‘Registration’ and then click on ‘New Registration’

- Once the page refreshes, select ‘New Registration’ and fill the form with the details carefully. Take care to enter information in all the fields marked with a red dot because providing this information is compulsory. Also, enter your email ID and phone number as you’ll receive an OTP on both

- Once filled, click on ‘Proceed’. Next, enter the OTPs that you have received on your email ID and phone number. You have a window of 10 minutes to do so, after which the OTP expires and must be regenerated

- The screen will then display a TRN or Temporary Reference Number. Note this, and then go back to the home page, click on the ‘Services’ tab, hover over ‘Registration’ and then click on ‘New Registration’

- This time, when the form is presented to you, click on ‘Temporary Reference Number’ instead of ‘New Registration’. Enter the TRN and the CAPTCHA code, as well as a new OTP that the system generates

- Once you’re directed to the ‘My Saved Application’ page, you will be able to access a form that you must fill and submit within 15 days. The form has 10 sections, so once you open it, be sure to fill in details in each section and affix scanned copies of your bank account number, IFSC code, proof of business incorporation, etc.

- Next, fill the enrolment form. Once again, take care to provide information for all fields that are marked mandatory. Then, click on ‘Save and Continue’. Similarly, fill in details that are mandatory as listed under the ‘Business’ and ‘Promoters/ Partners’ tab while providing proof of constitution

- Lastly, provide information under the ‘Authorized Signatory’ section. If you’re keen on e-signing the form, make sure to use the signatory’s mobile number and email ID. Similarly, to sign via DSC, ensure that the signatory’s PAN is linked with DSC

- Then, continue to fill the rest of the tabs, namely ‘Primary Place of Business’, ‘Goods and Services’, ‘Bank Accounts’, etc. using data from relevant documents such as the first page of a passbook or bank statement and proof of primary place of business

- An important aspect is to sign your application via e-signing, DSC or EVC digitally. This is compulsory for companies and LLPs, and the signature of the authorised signatory, as stated in the registration form, must be used. You can then submit your application

- You will receive an Application Reference Number or ARN on your mobile number and email ID shortly after to help you track your application

- Once the GST officer approves the application, you’ll be assigned a unique GSTIN for your business. You will receive a notification via email and text message. You will also receive a temporary username and password that you can use to log in. Once you do, click on ‘First Time Login’ to create your username and set a new password

- After three to five days have passed, you can download your registration certificate by navigating to the ‘Services’ tab. Click on ‘User Services’ and then on ‘View or Download Certificates’ to do so

There is a two-step verification process for businesses to complete the GST registration. Once the GST officer approves the application, you’ll be assigned a unique GSTIN for your business.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply