Implementing the goods and service tax on July 1st 2017 has led to one of India’s greatest tax reforms of all time. GST is a comprehensive tax levied on the supply of goods and services that replaces all other indirect taxes such as central excise duty, state VAT, central sales tax, purchase tax, etc. So, whether you are a trader, manufacturer or service provider, you need to register under GST to file returns.

If you’re wondering how to file GST returns or how many returns in GST you have to file, you can visit the GST login portal to find answers to all your queries and file GST online. First, you should know how to register for GST and how to get your GST number.

What is GST return?

A GST return is a document that mentions all GST invoices, payments, and receipts for a specific period. A taxpayer is liable to declare all transactions related to the business’s revenue based on which the authorities will calculate the amount of tax to be paid by the company.

Business owners can file GST online on the official portal provided by GSTN.

While filing GST returns, the registered dealer requires the following details for the concerned period.

- Total sales

- Total purchases

- Output GST (GST paid by customers)

- ITC or input tax credit (GST paid by the business for purchases.

Once filed, a registered dealer can check GST return filing status online and comply with requirements accordingly.

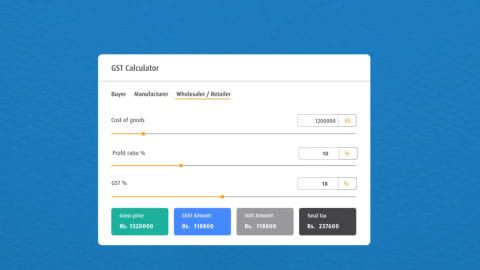

Additional Read: How to calculate GST

In addition, you also need to understand and choose the correct form before you initiate the GST return filing procedure. There are 11 types of returns applicable under the GST regime, and each form has a different purpose and due date. For example, you will have to file GSTR-1 by the 10th of every month if you are filing details of outward supplies of taxable goods. Once you have this information and know your GST number, choose the appropriate GST form and file GST online by the due date.

Types of GST returns

The types of GST returns filed by regular taxpayers include the following.

| S.No | Return | Particulars |

|---|---|---|

| 1. | GSTR 1 | Contains details of taxable goods or services, or both and that of outward supplies. |

| 2. | GSTR 2 | Carries details of inward supplies related to taxable goods and/ or services, along with ITC claims. |

| 3. | GSTR 3 | Includes information on monthly returns based on finalised details related to inward and outward supplies. It also contains details of the total tax payable. |

| 4. | GSTR 4 | Carries details related to quarterly return filing, specifically for compounded tax liabilities of specific individuals. |

| 5. | GSTR 5 | Includes details of GST return filing for non-resident foreign individuals. |

| 6. | GSTR 6 | Serves as the form for input service distributors to file returns. |

| 7. | GSTR 7 | Serves as the form that facilitates return filing for authorities initiating TDS. |

| 8. | GSTR 8 | Carries supply details for e-commerce operators along with the tax amount collected as per sub-section 52. |

| 9. | GSTR 9 | Serves as the form to file annual returns. |

| 10. | GSTR 9A | Includes details to file annual returns relative to compounding taxable individuals registered u/ s 10. |

Ten steps to file GST return online

- Ensure that you are registered under GST and have the 15-digit GST identification number with you based on your state code and PAN. In case you do not have this number, first register online to get it.

- Next, visit the GST portal.

- Click on the ‘services’ button.

- Click on ‘returns dashboard’ and then, from the drop-down menu, fill in the financial year and the return filing period.

- Now select the return you want to file and click on ‘prepare online’.

- Enter all the required values, including the amount and late fee, if applicable.

- Once you have filled in all the details, click on ‘save’ and see a success message displayed on your screen.

- Now click on ‘submit’ at the bottom of the page to file the return.

- Once the status of your return changes to ‘submitted’, scroll down and click on the ‘payment of tax’ tile. Then, click on ‘check balance’ to view cash and credit balance so that you know these details before paying tax for respective minor heads. Next, to clear your liabilities, you need to mention the amount of credit you want to use from the credit already available. Then click on ‘offset liability’ to make the payment. When confirmation is displayed, click on ‘ok’.

- Lastly, check the box against the declaration and select an authorised signatory from the drop-down list. Now click on ‘file form with DSC’ or ‘file form with EVC’ and click on ‘proceed’. Make the payment in the next step for your respective GST.

Additional Read: What is GSTIN number

The GST network stores all the information on registered sellers and buyers. So, if you own a company engaged in the supply of goods and services, you will have to file three monthly returns and one annual return using the simple spreadsheet template.

You may also like to read:

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply