After almost a decade-long discussion, speculation, and innumerable debates, the Indian government finally implemented a single indirect tax known as the Goods and Services Tax (GST) on July 1, 2017. This ‘One Nation One Tax’ regime recorded a GST revenue of Rs. 1.03 lakh crore in April 2018. This amendment has proven to be a much-needed boost for economic revival while opening new avenues of practice for CAs.

However, this change also calls for employing GST-ready software for practising chartered accountants to meet operational and compliance needs for their practice and their clients. Here are some of the leading GST software available to chartered accountants practising in India:

1. Thomson Reuters' OneSource

OneSource by Thomson Reuters is one of the leading compliance software available in India, providing a host of holistic and integrated solutions for your tax calculation needs. This software caters to your dual needs for tax determination and tax compliance.

You can undertake CGST, SGST, and IGST calculations as well as stay up-to-date with key happenings in India’s GST legislation. This software offers you the flexibility to accommodate 3 to 50 users.

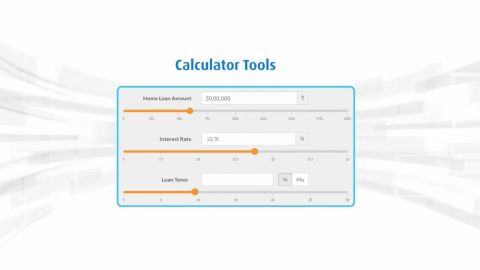

For 50 users, this tool is priced at Rs. 71,22,360. You can now fund software purchases with the help of a high-value loan for chartered accountants.

2. SAP

Systems, Application and Products, a well-known application service provider, has introduced ‘GST in a box’, an all-inclusive solution for small and medium enterprises. Existing SAP users can switch to the updated versions of SAP ERP 6.0 (600) SP26 or higher version.

SAP users utilising the TAXJIN procedure for tax calculation now require switching to the TAXINN procedure, a concept-based procedure, unlike the previous formula-based procedure. Cloud-based SAP modules are priced at Rs. 50,000 per year with the ability to process 2 lakh invoices/ year, with unlimited users and 20 GST identification numbers.

3. Tally ERP 9

This is popular offline accounting software specifically designed for accountants. ERP 9 includes modules like HR, payroll management, inventory management, billing and invoicing, supplier and purchase order management, tax management and product database.

Tally is a cost-effective software available in both single-user and multi-user categories. The single-user version is priced at Rs. 21,780, while the multi-user version is priced at Rs. 65,340. However, remember that you would require LAN connectivity and a stable IP address for multi-user access.

4. Reach Accountant

The most straightforward GST filling software available in India, Reach Accountant, is ideally suited for tax consultants. This software provides dedicated chatbots to support users and solve any operational issues they might face.

The modules covered by Reach Accountant includes GST preparation, GST reconciliation, GST filing, import and export of data and also provides you access to e-learning platforms. You can avail of the services of this tool by paying a sum of Rs. 18,000 under the ‘gold package’ designed to use by multiple users.

If you plan to avail of a loan for incorporating any of these GST tools, you can check your pre-approved offer from Bajaj Finserv for hassle-free and instant financing.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply