Under the present GST regime, every individual or company that supplies goods and services must register under Goods and Service Tax (GST). So, if you run a business with an annual turnover that exceeds Rs. 20 lakh (in all Indian states, other than north-eastern states), you will have to register with GSTN (Goods and Service Tax Network).

Once you have registered under this regime, you will receive a unique GSTIN (Goods and Service Tax Identification Number). The Central Government issues a state-wise, 15-digit number to you once you complete registration. There are many advantages of GST registration, one of which is, getting a legal identity as a supplier. You can also avail of input tax credit and collect GST from recipients of goods and services.

Documents required for GST registration

Take a look at the documents you will need to upload while registering under GST.

- PAN card of the applicant

- Partnership deed or incorporation certificate

- PAN cards, voter IDs, or Aadhaar cards of promoters and/or partners

- Address proof of the business in the form of an electricity bill, rent or lease agreement or for an SEZ, documents issued by the government

- Bank account statement of the company, firm, or individual

To check the ARN status for your registration by entering the ARN, visit this page of GST portal.

GST Registration Process

You can register for GST online through a government portal or register at a GST Seva Kendra.

Take a look at how to register for GST online in a few easy steps.

- Go to the GST portal.

- Click on ‘Registration’ under the ‘Services’ tab and click on ‘New registration.’

PART A

- Select ‘taxpayer’ from the drop-down menu of ‘I am a.’

- Now, fill form GST REG-01 for your new registration and enter details such as the legal name of your business, state, email address, mobile number, and PAN card.

- Verify your information by entering the one-time password sent to your mobile number and email ID, and click on ‘Proceed.’

- After verification, you will receive a Temporary Reference Number (TRN) when you complete the process and move to Part B. Note down this number.

GST registration – PART B

- To start with part B, log in with your TRN and enter the CAPTCHA code. Complete the OTP verification with the OTPs sent to your email id and registered mobile number. You will then be redirected to the GST registration page.

- Submit business information such as your company's name, PAN, the state where you're registering your business, date of business commencement. Here, you have to mention if you have any existing registrations.

- Then, submit details of up to 10 promoters or partners of your business. In the case of a proprietorship firm, you will have to submit the details of the proprietor. You will have to provide personal details, designation, DIN (Director Identification Number), PAN, and Aadhaar number.

- Next, submit the details of the person you have authorized to file GST returns.

- Add the principal place of business, enter the address, official contact details, and nature of possession of premises.

- Add details of any additional places of business, details of goods and services to be supplied, and the company's bank account details.

- Upload the required documents based on the type of business you are registering.

- Now click on ‘Save and continue’. Once you submit the application, you will need to sign it digitally.

- Click on ‘Submit’ to save your details.

- After submission, you will receive an Application Reference Number (ARN) via email or SMS to confirm your registration.

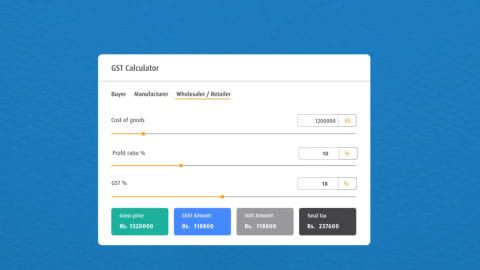

Additional Read: How To Calculate GST

GSTN is a unique number quoted on all invoices supplied to the input tax credit mechanism. It helps you avail of the input tax credit, register your business, and improve your credibility in the industry. You need to become GST compliant and file GST returns on time. Once you register, you can also download the registration certificate from the GST portal.

You may also like to read:

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent inaccuracies or typographical errors or delays in updating the information. The material contained in this site, and on associated web pages, is for reference and general information purpose and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Subscribers and users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. In case any inconsistencies observed, please click on reach us.

*Terms and conditions apply